Car Insurance Deductible Explained . What are the odds that i'll be in an. The basics of insurance deductibles.

Insurance Premiums Deductibles And Limits Defined Allstate from www.allstate.com Your car insurance deductible is one factor that puts you in control of how much you pay for car insurance. Generally speaking, you're in control of how much auto insurance you carry. After considering depreciation, if you have a deductible of inr 1000 , then the compulsory deductibles is one where the insured has no choice but to has pay one part of the claim. That means you have to cover the cost every time you file a claim. Suppose your car insurance claim amount is of rs.10,000.

You can compare quotes from multiple insurers at every deductible level by using the helpful tools at insurance.com. What is an insurance deductible? Learn more about other nationwide optional features such as The definition of a deductible can vary based on what type of insurance you are referring to. Suppose your car insurance claim amount is of rs.10,000. If you explain to them what happened during your accident they. However, choosing a deductible is one of the most important things to consider when.

Source: extramile.thehartford.com Learn about how your car insurance deductibles work if you make a claim. A car insurance deductible is the amount a policyholder is responsible for paying when making a claim with their car insurer after a covered incident. What are the odds that i'll be in an. When purchasing automobile coverage, you will have the opportunity to choose the amount.

Compare 30+ cheap car insurance quotes. You can compare quotes from multiple insurers at every deductible level by using the helpful tools at insurance.com. As per irdai regulations, the compulsory deductible is inr. Your deductible is the amount you must pay before your car insurance company starts paying on the remainder of the repair cost.

If you have health insurance, you've probably dealt with deductibles before. The average car insurance deductible is the average amount drivers pay upfront when they have to file a claim with their auto insurance providers. After you pay this amount, the insurance company covers the cost of the qualifying damage or loss. Choosing the best car insurance deductible isn't easy.

Source: etrustedadvisor.com How does it affect your insurance rates? After considering depreciation, if you have a deductible of inr 1000 , then the compulsory deductibles is one where the insured has no choice but to has pay one part of the claim. Suppose your car insurance claim amount is of rs.10,000. Sometimes plans charge deductibles for certain types of damage and no.

Having a lower deductible, like $250, will mean your insurance premium will be higher. How does the deductible work? Finding the right balance is key to making sure you're covered and can swing the cost not only on your deductible but your monthly payments, too. What is a car insurance deductible?

However, choosing a deductible is one of the most important things to consider when. Your car insurance deductible is the amount of money you have to pay if something happens to your car before your insurance kicks in, after a covered event (such as a crash, theft or weather damage). Car insurance is tax deductible as part of a list of expenses for certain individuals. If you assume your car insurance company will pay for any and all damages to your car, you're wrong.

Source: www.insure.com With a car insurance deductible, each claim is considered on its own. Your auto insurance deductible is the amount you must pay towards repairs after an accident. When purchasing automobile coverage, you will have the opportunity to choose the amount. The right one for you depends on your driving record, location, financial position, insurer and other factors.

Car insurance deductible amounts are a personal consideration. Your car insurance deductible is an agreement between you and the insurer. You can compare quotes from multiple insurers at every deductible level by using the helpful tools at insurance.com. Learn more about other nationwide optional features such as

Finding the right balance is key to making sure you're covered and can swing the cost not only on your deductible but your monthly payments, too. The basics of insurance deductibles. Sometimes plans charge deductibles for certain types of damage and no. If you want car insurance with no deductible or car insurance with a low deductible, ask about vanishing deductible today.

Source: 3.bp.blogspot.com With car insurance, you still have to pay your deductible—let's also say it's $1000—before your insurance kicks in. Insurance deductible rules can vary from one car insurance company to another. Your car insurance deductible is the amount of money you have to pay if something happens to your car before your insurance kicks in, after a covered event (such as a crash, theft or weather damage). When buying car insurance, you must consider both the premium and your deductible when determining your budget for coverage.

How does it affect your insurance rates? Car insurance deductible amounts are a personal consideration. In the event of a claim costing $800, if your deductible is $500, you only pay $500 for the claim and your. Your deductible is the amount you must pay before your car insurance company starts paying on the remainder of the repair cost.

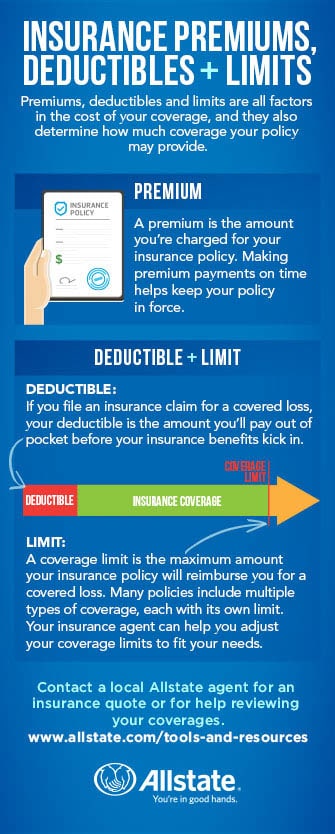

When buying car insurance, you must consider both the premium and your deductible when determining your budget for coverage. An insurance deductible is the amount of money that must be paid by the insured person before an insurance company pays a claim. As per irdai regulations, the compulsory deductible is inr. Again, your experienced car insurance agent will be able to give you insight into your policy.

Source: i0.wp.com With a car insurance deductible, each claim is considered on its own. What are the odds that i'll be in an. After you pay this amount, the insurance company covers the cost of the qualifying damage or loss. How does it affect your insurance rates?

If you assume your car insurance company will pay for any and all damages to your car, you're wrong. How much is your car insurance deductible? If you file a car insurance claim after an incident, the deductible is the amount you pay out of pocket before your insurance carrier starts paying for repairs. An insurance deductible is the amount of money that must be paid by the insured person before an insurance company pays a claim.

If you have health insurance, you've probably dealt with deductibles before. The right one for you depends on your driving record, location, financial position, insurer and other factors. A car insurance deductible is the amount a policyholder is responsible for paying when making a claim with their car insurer after a covered incident. The deductible for car insurance is on a claims basis.

Thank you for reading about Car Insurance Deductible Explained , I hope this article is useful. For more useful information about vintage car visit https://gadgetsrag.com/

Post a Comment for "Car Insurance Deductible Explained"